As mentioned in our last blog post, it’s finally time to bring Swivel out of the dark and leave it to the community to give us the important feedback necessary to launch a product that is useable for all parties, not just institutions.

Introducing Swivel v1’s rolling-maturity markets, currently live on Kovan.

Along with the testnet, we’re happy to announce our $5,000 testnet bug bounty program. Users will be rewarded for reporting bugs based on their severity and uniqueness. If you’re the first to report a severe issue, you’ll be rewarded most!

Submit your issues here. We will be accepting submissions until our v2 testnet, at which point payments will be sent out and a new round will begin!

First Steps

In order to interact with our Kovan testnet, users will first need to acquire both Kovan ETH as well as Kovan DAI.

Kovan ETH can be acquired using either the:

Once in possession of Kovan ETH , one can then easily swap some of their ETH to Kovan DAI using the kovan deployment of Uniswap.

At that point you’re ready to head on over to swivel.exchange!

Swivel Exchange

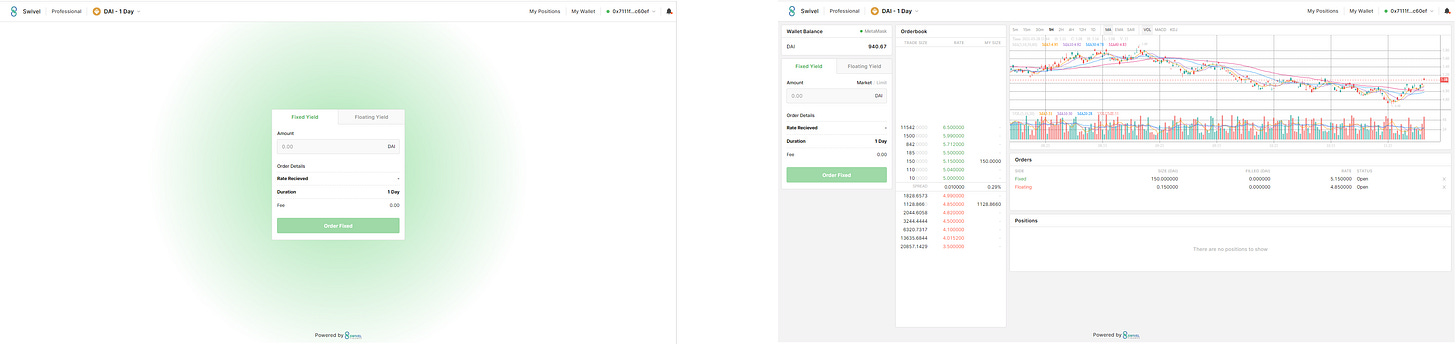

The Swivel Exchange comes with both a basic interface that allows users to easily take positions, as well as a professional trading interface that allows for enhanced precision through the creation of limit orders (while also avoiding gas fees).

Fixed-Rate Lending:

If all a user wants to do is get a fixed-yield at the best rate possible, they can easily do so using our basic application.

Steps to lock in a fixed-rate position:

Select your desired asset and lending period (Testnet only supports DAI - 2 Weeks)

Approve the Swivel contract access to your Dai.

Input the amount of principal you would like to lend, identifying the rate you will receive.

Lock in your fixed-rate position!

Interest-Rate Leverage:

Similarly, if all a user wants to do is get the most money-market leverage possible for their capital, they can easily do so using our basic application.

Steps to lock in a leveraged-floating vault (cUSDC vault):

Select your desired asset and lending period (Testnet only supports DAI - 2 Weeks)

Select the Floating tab.

Approve the Swivel contract access to your Dai.

Input the amount of Dai you would like to spend, identifying the amount of leverage and equivalent cDai vault will be received.

Lock in a floating-position, paying a fixed-maintenance rate and accessing significant (~10-100x) leverage on Compound’s money market!

We would appreciate if users would limit their floating orders ~.1-1 Dai. We are only able to put ~10,000 DAI on our orderbook for our users to test which, due to the extremely short test lending period, may be consumed very quickly. At that point it will be up to the users to create additional fixed-yield limit orders for consumption.

Releasing Positions:

Once a position’s maturity has been reached, it can be released to return its underlying principal + fixed-yield to one party, and interest generated from Compound to the other.

Steps to release a position:

Navigate to the “My Positions” page.

Wait for the maturity shown to be reached.

Click “Release”!

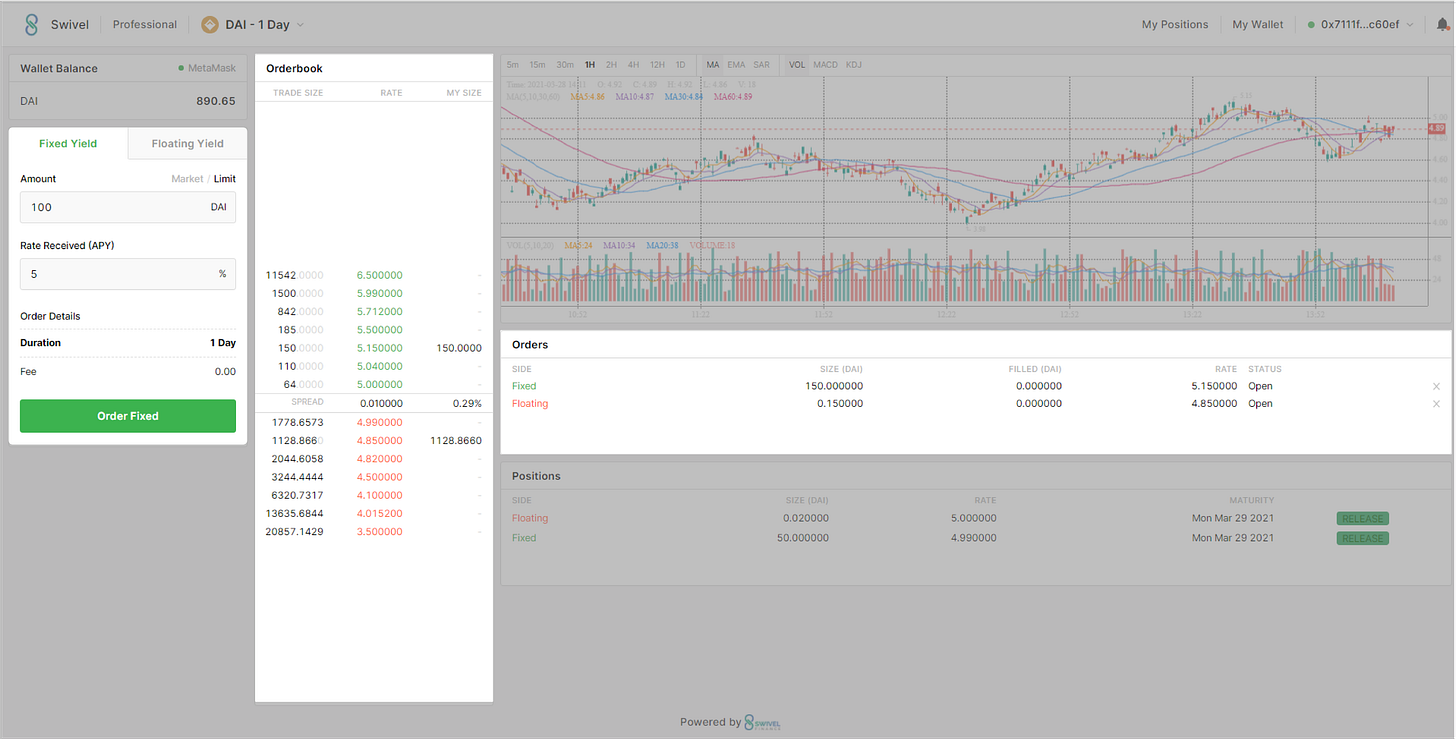

Professional Trading Interface:

For those users looking for the ability to conduct more advanced analysis and/or place orders with precision, we also offer a “professional” trading interface.

Placing Limit Orders:

When placing limit orders, users avoid interacting directly with Ethereum, meaning gas fees are negated for users willing to provide liquidity to our orderbooks.

Steps to place a Limit Order:

Fixed-Yield Order:

Select your desired asset and lending period (Testnet only supports DAI - 2 Weeks)

Approve the Swivel contract access to your Dai.

Input the amount of principal you would like to lend.

Input the rate you would like to receive.

Place your order.

Sign the order, in the process adding it to our orderbook!

Floating-Yield Order:

Select your desired asset and lending period (Testnet only supports DAI - 2 Weeks)

Approve the Swivel contract access to your Dai.

Input the amount you would like to spend

Input the fixed-rate you are willing to pay. (Amount of leverage you will receive)

Place your order.

Sign the order, in the process adding it to our orderbook!

Whats Next?

Over the next couple days, we’ll be releasing more in depth explanations of our testnet functionality as well as plans for our v2 testnet. There are *significant* upgrades in the pipeline and we’re excited to share all we’ve been working on with our community.

And a final note on community… We want to take a moment to reiterate how grateful we are for the incredible support we received in Gitcoin Grants round 9. We decided to reject any CLR funding and still ended up with roughly $16,000 in donations that will be used in their entirety to back the sustenance and growth of our community!

Expect an additional Gitcoin Grants round 9 wrap-up over the coming week as we discuss the future of community-generated funding and growth.

Website | Substack | Discord | Twitter | Github | Gitcoin

Hello, i enjoyed partaking in this great testnet project but simply note that your recommended website Gitter faucet and Enjin faucet are not dishing any kovan ethereum for the testnet purpose because i personally applied but was given any. i only made use of the kovan ethereum i had long ago.

My address is 0xa3B5F6E5d0aeF7e0D55F36049e030689A4b26e40 is on the reward list but the reward hasn't been on my wallet yet. Please check it out for me.