🥁🥁🥁 The Swivel Governance Token is now LIVE!

We officially launched Swivel’s public mainnet on February 10, 2022 and have since prepared two upcoming new integrations — Rari & Arbitrum — as well as blown away any expectations for Swivel Exchange volume.

Over the past 28 days, the Swivel Exchange has processed over $142,000,000 in USDC volume on only two short term markets, and with a current sustained average of ~8m a day, our protocol is projected to facilitate nearly $3 billion in fixed-rate lending this year!

This sort of growth leaves us pumped for the future and more than anything represents the immediate need for us to begin the process of handing control of protocol governance over to our community.

And the first step: Launch the Swivel Governance Token!

Token Address: 0xbf30461210b37012783957D90dC26B95Ce3b6f2d

Etherscan: Link

As announced in a previous blog post, Swivel Governance Tokens were allocated to the following groups:

0.5% Guarded Mainnet Lenders

1% Verified Community Contributors (Verified Feedback & Content)

0.5% Gitcoin Kernel Alumni & Mentors

2% Compound, Aave, FEIRari (Fei + Rari) & Gitcoin On-Chain Governance Participants

A full updated list of all currently recorded addresses and unlocked amounts is available here:

Our First Live Proposal

Ok, you’ve got some SWIV! (Or if you need help to claim your SWIV, follow this guide.) After getting your SWIV tokens, head on over to our Snapshot and vote on our first proposal, SIP #001! (https://vote.swivel.finance)

SIP (#001): SWIV Token Liquidity Incentives

After a lively discussion in our governance forum, our community was in ubiquitous agreement that a capital efficient liquidity program on Uniswap-v3 was their first choice for potential incentives.

With that in mind, SIP #001 is now live on Snapshot.

Take your SWIV and vote! We need YOU to help decide whether to provide incentives at all, and, if so, help pick between SWIV/USDC and SWIV/ETH or both.

SWIV Distribution Schedule:

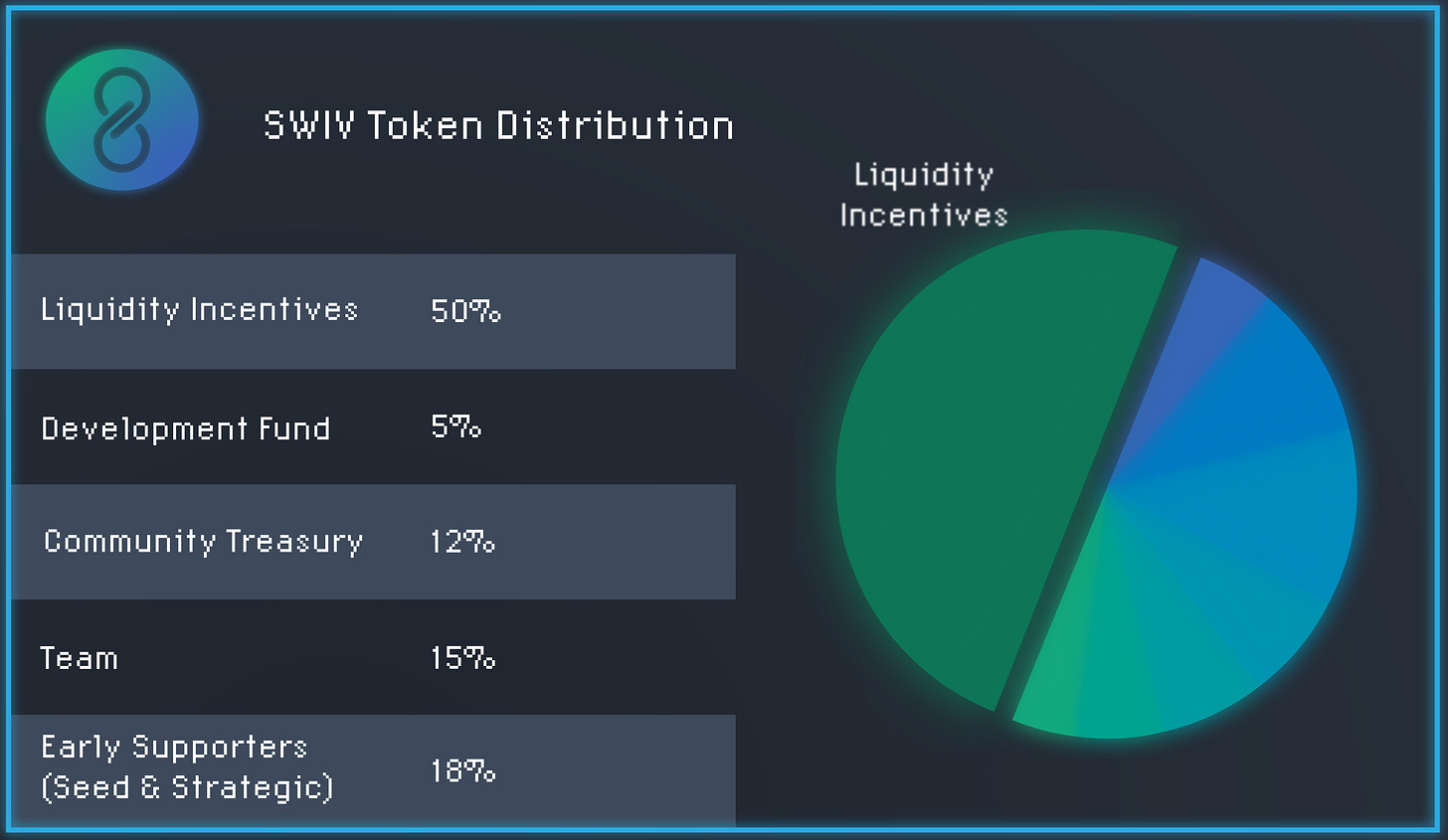

The maximum total supply of SWIV is capped at 100,000,000 SWIV tokens.

Further, with the 4% retroactive community distribution in mind, the initial circulating supply of the Swivel Governance Token may be upwards of ~4,000,000 SWIV with an additional 2,000,000 SWIV loaned to our partner, GSR Markets, to assist with any necessary centralized market liquidity provision (only circulating upon the launch of SWIV on a centralized exchange).

The specifics of our distribution schedule are as follows:

Liquidity Incentives: Our liquidity incentive program is to be distributed linearly over a 4-5 year period, subject to any changes effected by governance

Team & Community Dev Fund: While the majority of the team allocation is currently unallocated, the allocated portion begins to unlock ~16 months post-launch.

Strategic & Seed Investors: ~12 month cliff, 16 month unlock

Community Treasury: None specified

What’s Next

Protocol Liquidity Incentive Update 🌊

With one month of liquidity provision and incentives under our belt, it’s time to review the effectiveness of our first incentive epoch and identify any changes that may be necessary!

A community member already introduced this discussion here: Link

We would like to move forward as soon as possible with proposed changes, so get your comments in ASAP!

Swivelmoji Competition Results

We’re still holding our breath! Stay tuned for a blog post of our emoji contest winners.

You’ve likely seen a few already added to discord, but who deserves to be considered a true meme master and connoisseur?

Monthly Developer Update 💻

We’re starting up a new series, regular developer updates in which our team will go deep in the weeds as we talk about the intricacies of an on/off-chain system, and all our dev plans for the future!

FeiRari 🏎️

We’re comin’ to Rari, and we’ll be live with our integration before March 24 (when our current cUSDC market ends)! Keep an eye out for timeline updates and votes to approve different markets!

About Swivel Finance

Swivel is the decentralized protocol for fixed-rate lending and tokenized cash-flows.

Currently live on Mainet, Swivel Finance provides lenders the most efficient way to lock in a fixed rate as well as trade rates, and gives liquidity providers the most familiar and effective way to manage their inventory. Through our exchange, traders can take on positions with minimal slippage, even in low liquidity markets.

Website | Substack | Medium | Discord | Twitter | Github | Gitcoin | Careers