Governance Update: Launching a DAI Market

SIP (#007) & (#008): Launching DAI 9-30 & Temporarily Ending SWIV/USDC incentives

Over the last week the Swivel DAO had two governance discussions progress to the proposal stage, and through a Snapshot vote!

Both SIP (#007) and SIP (#008) then passed quorum, with the most important result being the launch of a new DAI market on top of Compound!

SIP (#007): Compound Stablecoin Market Launch

As the biggest action item for the DAO, we’ve prioritized implementation of SIP (#007) with the immediate launch of a new market for Compound DAI, starting June 23rd, and maturing September 30th.

SIP (#007) was one of the closest votes that the DAO has had yet, with DAI receiving ~50.23% of the votes, and USDC a close second at ~45.75%.

Link: Snapshot

Result

Given the close vote, we will be launching a DAI market immediately, however, we will revisit a new USDC market once the DAI market accrues enough liquidity.

(Though Swivel v3 is right around the corner!)

New market Information:

Asset: 0x6B175474E89094C44Da98b954EedeAC495271d0F

Maturity: 1664550000

With our June markets maturing in two days, make sure to remember to roll your positions over!

For instructions / an explanation of how to roll over your position, check out our recent guide: Link

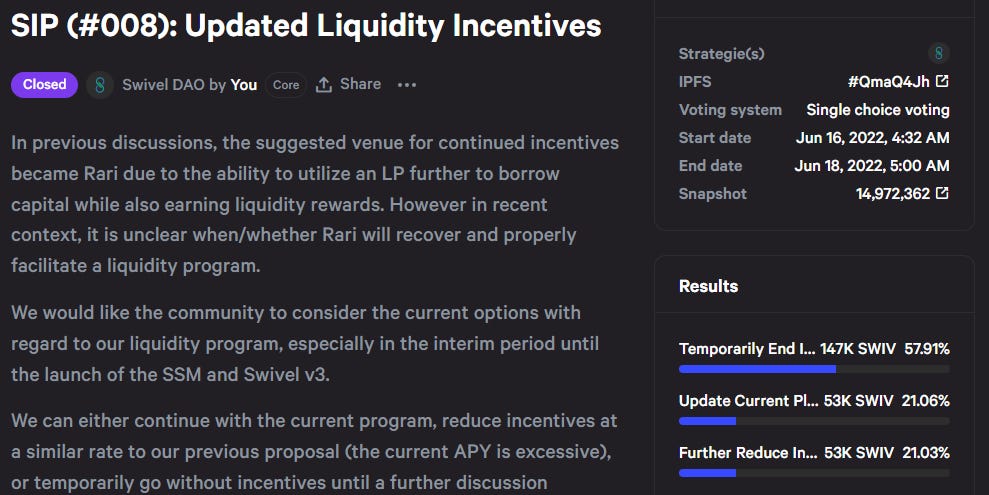

SIP (#008): Updated Liquidity Incentives

The second SIP related to the continuance of SWIV incentives on our SWIV/USDC pool.

After some interesting discussion throughout our community, as well as input from a number of external analysts, opinions appeared to support the continued reduction of incentives.

We had planned to shift towards incentives through a Rari Fuse pool; however in context of the recent Rari vulnerability, these plans are currently on hold.

With all this in consideration, SIP (#008) asked the community whether incentives should continue, be reduced, or temporarily discontinued until Rari or another efficient program is available.

Result

The community voted to temporarily end our SWIV/USDC incentive program, with a significant ~57.91% support.

With this conclusion, the previous staking program concluded on 06/18/2022. We will revisit further incentive programs through the normal governance process.

To claim your previously earned rewards, visit our community hosted staking interface: Link

What’s Next 🔥

The Swivilians and the Swivel DAO have a LOT going on. To keep track of it all, hang out in our discord and chat shit in #💧the-watercooler. Here are a few hot topics to pique your interest.

ETH New York 🗽

Come on by our booth at ETH New York to meet the team! We’re sponsoring the hackathon and will be around all weekend with tons of Swivel swag!

Julian will be presenting on “A Developer’s Guide to Trading Rates” on Friday at 5:30 PM, and more than anything, give a go at our hackathon bounties with up to $5000 up for grabs!

And to get the creativity going, here are a few initial ideas for you guys: Link

Swivel 3.0 💥

We’ve been cooking up something big with Swivel 3.0! Heading into the arena again with Code4rena on 07/05 🐺

For some early alpha check out an early build (Link), and hang out in our discord / ask questions! Swivel 3.0 enables some revolutionary strategies that no other protocols can cover, and we’ll be dropping some strategy alpha over the coming weeks!

Illuminate 💡

And our frens over at Illuminate are already in the arena themselves!

As one of our first integrations, the Swivilians are throwing all their support as the Illuminate devs face off against the wardens and rip their contracts apart.

If you want to participate in either Illuminate or our upcoming competition, check out Code4rena and become a warden: Link

About Swivel Finance

Swivel is the protocol for fixed-rate lending and tokenized cash-flows.

Currently live on Mainnet, Swivel provides lenders the most efficient way to lock in a fixed rate as well as trade rates, and liquidity providers the most familiar and effective way to manage their capital.

Website | Substack | Discord | Twitter | Github | Gitcoin | Careers