Another Look At DeFi Fixed-Rates & Rate Swaps

A Review of Previous Thoughts and Analysis of Additional Designs

In my previous review in September, I took a look at a few of the live and proposed mechanisms for both fixed-rate lending and interest-rate swaps (leveraged rate exposure) around the space. In that review I made some strong claims, and with the recent launches of both Yield and Notional, it's about time I took a look at how a few of my assumptions have panned out, as well as introduced/investigated two additional projects, Horizon Finance and 88mph.

Quick Recap

In my last article, I went over the benefits and drawbacks of zero-coupon bonds like Yield, Notional, UMA, etc., in comparison to directly collateralized designs like Swivel and SwapRate.

As a refresher, zero-coupon bonds (ZCBs) allow users to collateralize their assets in return for a coupon redeemable for $1 at a specific date in the future. The concept of a collateralized dollar is not all that unlike MakerDAO, however with a ZCB the lost time-value results in an instrument that is priced below $1 and, over time, appreciates towards its redeemable coupon value. This mechanism then allows both borrowers and lenders to sell/purchase these coupons off of an open market in order to lock in fixed rates.

Our proposed alternative, direct collateralized swaps, takes a much simpler approach towards facilitating fixed-rates in that we provide the infrastructure for an open marketplace of fixed-rate lenders and floating-side speculators that directly arbitrate fixed-rates, all without the need for overcollateralization and potential liquidation. This design allows Swivel to offer unmatched (~10-100x) leverage on money markets like Compound, or Aave, without adding significant contract risk (due to the lack of collateralization and therefore oracle attack exposure -- the most common protocol vulnerability).

Previous Conclusions

Zero-coupon bonds like Notional and Yield will likely find a niche in fixed-rate borrowing

Zero-coupon bonds require substantial amounts of liquidity and for this reason may result in a hard to jumpstart market and significant slippage

Direct swaps provide a practical solution for leveraged money market exposure

Direct swaps likely provide a comparatively efficient solution for fixed-rate lending

Post-Launch Reviews

With Yield’s launch on October 19th, and Notional’s response and launch on October 26th, many of the claims made in my previous article have had sufficient time for some initial objective evaluation.

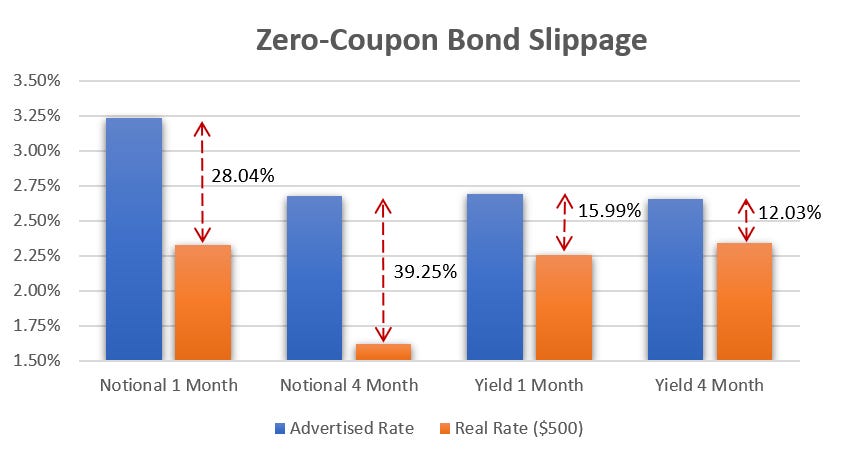

Given my primary criticism of the zero-coupon bond model revolves around the significant amount of liquidity required to support an AMM based zero-coupon bond market (and significant unavoidable slippage), the KPI of greatest interest is spread/slippage.

Notional

Notional has clearly had the larger issue with the bootstrapping of their early markets. With ~61,000 Dai currently provided to the January market and ~87,000 Dai provided to the April market, their product is currently in a bit of a short term limbo.

This slow start then results in significant slippage (~20-40%) that is completely unavoidable when taking a position on the protocol.

Notional’s initial poor performance may (and very likely will) improve, both over time naturally, and with the incorporation of additional system incentives, however, for now, it seems that Notional has hit a bit of a wall. That said, I still believe that Notional will compete within the fixed-rate borrowing niche in the near future.

Yield

Yield’s launch may have been aided by their slight first movers advantage, or more likely by external relationships, however regardless of cause, Yield clearly launched with a bit more momentum. Though the number of transactions in each Yield market is relatively low (sub 50), ~515,000 Dai are currently provided for liquidity across the five live Yield markets.

This results in a relatively improved degree of slippage (~10-20%) when compared to Notional (~20-40%). However, the amount of slippage for a small $500 order remains impractical for most users (and is necessary with an AMM).

Similar to Notional, I expect that this performance will naturally improve with time, as well as with the addition of further incentives. With this in mind, I still believe that, as mentioned in my previous review, Yield will be the favorite within the fixed-rate borrowing niche.

Conclusion

While I expect that these results will improve as time passes, and the niche of fixed-rate borrowing will find growing demand, the underlying impracticality of zero-coupon bonds seems to have been validated in the short term.

Due to the many levels of liquidity necessary to maintain an AMM-ZCB design across lending, borrowing, liquidity provision and liquidation, it may be difficult to bootstrap a market. And further, because AMM’s inherently require users to accept slippage (or sub-optimal order flow), these issues may always persist to some degree.

Horizon Finance

Unlike Notional and Yield, and somewhat similar to Swivel, Horizon takes the approach of backing fixed-side lending agreements with floating-side speculative capital.

That said, Horizon is mechanically quite unlike the previously reviewed designs. As opposed to the ability to instantly enter into a lending agreement, Horizon instead has “rounds” with fixed execution times, before which lenders can bid on given lending positions. This has interesting effects, the primary benefit being a relatively dynamic pricing mechanism between the fixed and floating tranches. However, this comes at the cost of a delayed execution period and a less than transparent bidding process.

As a fixed-rate lender, one must commit capital together with a fixed-rate bid and until the round executes, a lender can change their bid according to the current market state.

On a surface level, this sounds appealing, however the result is that any fixed-rate lender must be vigilant with the state of the market, and ready to move their position. This may be acceptable in traditional off-chain contexts, however on-chain, not only may this be inconvenient, but likely results in a frontrunning competition within the rounds execution block.

Then in a frontrunning competition, should a large fixed-side lender have the ability to undercut the market, he/she can allocate capital and effectively guarantee their own yield, likely at the cost of those who had been undercut.

I look forward to Horizon’s launch, and it may be the case that Horizon has considered this potential roadblock. However if that is not the case, Horizon may end up capturing a market of more speculative users rather than those looking for easy to access fixed-rates or direct leverage.

88mph

In comparison to the previously discussed designs, 88mph takes a less dynamic approach towards the collateralization and pricing of their fixed-rates.

Unlike the other designs which implement a demand mechanism in one form or another to set a market fixed-rate, 88mph simply takes a current underlying money-market rate and offers a 25% haircut for those looking to lend at fixed-rates.

In order to remain solvent when then backing these fixed-rates, 88mph’s design inherently assumes that the money-market rate will not vary by greater than the 25% haircut offered. Further, the 88mph documentation then suggests that the capital generated by future protocol deposits will offset potential default risk.

This assumption obviously carries with it a lot of ponzi baggage, as this effectively means future deposits may be paying the yield of early adopters, however 88mph has a bandage for this issue, termed “floating-rate bonds”.

These floating-rate bonds allow lenders to back given fixed-rate positions while gaining leverage on an underlying money market, but this addition to 88mph’s design comes with a number of inherent drawbacks.

Without the ability to arbitrate market rates directly, fixed-rate positions may sit without floating-side counterparties (while exposing the protocol to risk) for extended periods of time as users have no input in their pricing. Further, given an underlying rate may vary significantly by the time a potential floating-side counterparty is found, this bandaid still leaves exposure to the ponzi risk already mentioned.

Finally, while decentralization has been of decreasing importance ideologically within web3, 88mph is one of few protocols that in part updates its EMA using off-chain operators (when not receiving on-chain calls). This is likely an acceptable method with the right incentives in place, and can be implemented in tandem with projects like keep3r, however reliance on off-chain actors is a source of operational risk that has historically been avoided when possible.

These issues place 88mph in the category of extremely interesting but seemingly experimental at this time. That said, their branding cant be beat and perhaps future implementations may find ways to ameliorate the dynamics mentioned.

Final Notes

While my portrayed thoughts on each of the mentioned designs may sound quite pessimistic, this representation is more a result of the analysis format than my personal opinion. That said each of the flaws I have mentioned may be present, but I am quite optimistic with regard to the adoption of all of the protocols mentioned above, and believe that with continued market growth, there is plenty of space for many designs to co-exist with varying advantages and risk profiles.

For those interested in joining our team and building towards our initial release we have positions across our stack: Jobs

If you don’t fit in, but know someone who might be a great candidate, we are now offering a $1500 referral bonus, just reach out to Juliant@DefiHedge.finance or have them apply through our jobs portal!

If any errors exist in my this review please bring them to my attention! In a nascent market there is a lot that one can miss, or misunderstand so feel free to reach out to help make any necessary corrections, or join our discord to share any thoughts!

Citations

Allan Niemerg. “Introducing yDai.” Aug. 2020.

Notional Team. “Notional Whitepaper” Apr. 2020.

Horizon Team. “Horizon Whitepaper”, Nov. 2020

Guillaume Palayer. “88mph launch 🛹🚗⚡️”, Nov. 2020

88mph Team. “88mph: How It Works”, Nov. 2020

Julian Traversa and William Hsieh. “DefiHedge: A Marketplace for Fixed Rate Defi Lending and Interest-Rate Derivatives v0.2.0” Sep. 2020.